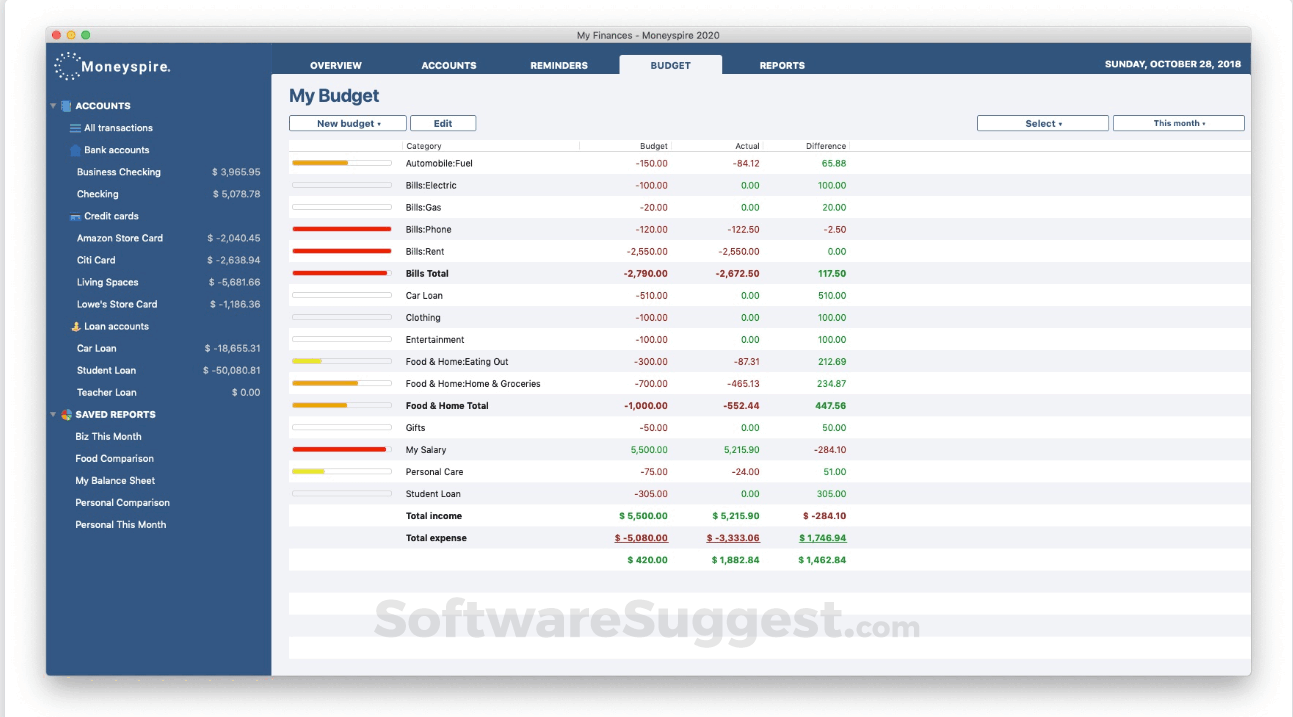

When you view all your expenses in one chart, you can quickly see which costs have a large impact as well as which ones may be small but could be avoided, and removed in the future.Īnd while the overall visual interpretation is helpful to spot major spending patterns, you can set a budget to more accurately keep track of spending on utilities, rent or mortgage, healthcare, insurance, and so on. For example, you will see what percentage of your money is spent on groceries, food, loans, childcare, gifts, and so on. We found the due date notification system next to the calendar to be an especially nice feature that informs you when the next bill payment is due.īy aggregating all your accounts into one place, you also get to see a big picture pie chart of how and where you are allocating your money. The calendar view lets you schedule upcoming bills, so you are not penalized by late fees when it slips your mind to send in payment on time. One of the standout features is billing and deposit reminders. It is straightforward to categorize income and spending and to balance your checkbook.

With an overview of your spending, income, and liabilities, you will have a more detailed view of your accounts. Whether it is your Amazon Prime Rewards Visa Signature Card, bank checking account, student loan, Kohl’s card, car loan, or almost any other financial account you may have, Moneyspire connects to them all and displays them in a dashboard for easy viewing. Moneyspire is designed to provide you a holistic view of all your accounts, so they are all in one place. It is hard to stay on top of your day-to-day finances when you have to log in to so many online accounts to keep track of your income and spending, as well loan payments, credit card bills, and investment performance returns. Some of the institutions we work with include Betterment, SoFi, TastyWorks and other brokers and robo-advisors. By letting you know how we receive payment, we strive for the transparency needed to earn your trust. Thank you for taking the time to review products and services on InvestorMint. With an ever increasing list of financial products on the market, we don’t cater to every single one but we do have expansive coverage of financial products. Our goal is to make it easy for you to compare financial products by having access to relevant and accurate information. We strive to maintain the highest levels of editorial integrity by rigorous research and independent analysis. We don’t receive compensation on all products but our research team is paid from our revenues to allow them provide you the up-to-date research content. Revenues we receive finance our own business to allow us better serve you in reviewing and maintaining financial product comparisons and reviews. When you select a product by clicking a link, we may be compensated from the company who services that product. Financial services providers and institutions may pay us a referral fee when customers are approved for products. Always use genuine version that is released by original publisher Moneyspire Inc.Investormint endeavors to be transparent in how we monetize our website.

MONEYSPIRE REMINDERS SERIAL

Do not use illegal warez version, crack, serial numbers, registration codes, pirate key for this personal finance freeware Moneyspire for Mac.

MONEYSPIRE REMINDERS SOFTWARE

The license of this personal finance software is freeware, the price is free, you can free download and get a fully functional freeware version of Moneyspire for Mac.

MONEYSPIRE REMINDERS FOR MAC

Moneyspire for Mac 2017.17.0.15 Personal Finance software developed by Moneyspire Inc. Moneyspire gives you all the tools to get your financial life on track today! Features include: a clean easy-to-use interface, mobile companion app, split transactions, reconciliation, multiple currency support, QIF, QFX, OFX and CSV file import, and much more. Generate detailed reports and charts and see exactly where your money is going, and make tax time easier. Set a budget for all your expenses and keep track of your progress to help you stick to your budget. Set bill reminders and see all your upcoming payments so you never forget to pay a bill again. and balance your checkbook and organize your transactions and see where your money is going. Keep track of your bank accounts, credit cards, etc. Moneyspire is the user-friendly personal finance software that brings your entire personal finances together in one place.

0 kommentar(er)

0 kommentar(er)